10,400 hours for the five employees paid for 2,080 hours each (5 x 2,080)

3,120 hours for the three employees paid for 1,040 hours each (3 x 1,040)

2,080 hours for the one employee paid for 2,300 hours (lesser of 2,300 and 2,080)

(2) Based on 15,600 hours of service, the employer has seven FTEs (15,600 divided by 2,080 = 7.5, rounded to the next lowest whole number).

Note that a church with 25 or more employees may qualify for the credit if some of its employees are parttime. This is because the limitation on the number of employees is based on FTEs. So, a church with 25 or more employees could qualify for the credit if some of its employees work parttime.

The amount of average annual wages is determined by first dividing the total wages paid by the employer during the employer’s tax year to employees who perform services for the employer during the tax year by the number of the employer’s FTEs for the year. The result is then rounded down to the nearest $1,000 (if not otherwise a multiple of $1,000). Only wages that are paid for hours of service are taken into account. Wages for this purpose means wages subject to Social Security and Medicare tax withholding.

Key point. The $50,000 average annual wage limit is adjusted for inflation beginning in 2013.

Example. For the 2010 tax year, a church pays a total of $224,000 in wages to employees who perform services during the tax year and has 10 FTEs. The church’s average annual wages are $22,000 ($224,000 divided by 10 = $22,400, rounded down to the nearest $1,000).

3. calculating the credit

Only premiums paid by the employer under an arrangement meeting certain requirements (a “qualifying arrangement”) are counted in calculating the credit. Under a qualifying arrangement, the employer pays premiums for each employee enrolled in health care coverage offered by the employer in an amount equal to a uniform percentage (not less than 50 percent) of the premium cost of the coverage. However, a qualifying arrangement also includes an arrangement under which the employer pays at least 50 percent of the premium cost for single (employee-only) coverage for each employee enrolled in any health insurance coverage offered by the employer.

Key point. If an employer provides employees with more than one type of health insurance coverage or if the employer’s health insurance provider does not charge the same premium for all employees enrolled in single (employee-only) coverage, the employer may meet the qualifying arrangement requirement even though the employer paid less than 50 percent of the premium cost for some employees enrolled in single (employee-only) coverage.

For tax years beginning in 2010 through 2013, only premiums paid to a health insurance provider for health care coverage are counted for purposes of the credit. A health insurance provider is either an insurance company or another entity licensed under state law to provide health insurance coverage.

The IRS has clarified that the term health insurance provider also includes “an arrangement under which an otherwise qualifying small church employer pays premiums for employees who receive medical care coverage under a church welfare benefit plan.” This conclusion is based on the Church Plan Parity and Entanglement Prevention Act of 1999, which states that “for purposes of enforcing provisions of state insurance laws that apply to a church plan that is a welfare plan, the church plan shall be subject to state enforcement as if the church plan were an insurer licensed by the state.” Based on this provision the IRS concluded that a church welfare benefit plan is subject to state insurance law enforcement as if it were licensed as an insurance company, and therefore meets the definition of a health insurance provider for purposes of the credit. As a result, insurance premiums paid by churches to many denominational health plans will be counted for purposes of the credit.

Premiums for health care coverage that covers a wide variety of conditions, such as a major medical plan, are counted, and premiums for certain coverage that is more limited in scope, such as limited scope dental or vision coverage, are also counted. However, if an employer offers more than one type of coverage, such as a major medical plan and a separate limited scope dental or vision plan, the employer must separately satisfy the requirements for a qualifying arrangement with respect to each type of coverage the employer offers (meaning the employer cannot aggregate these different plans for purposes of meeting the qualifying arrangement requirement).

Key point. An arrangement under which an otherwise qualifying small church employer pays premiums for employees who receive medical care coverage under a church welfare benefit plan may be a qualifying arrangement for purposes of the small business health care tax credit.

Key point. Employer contributions to health reimbursement arrangements (HRAs), health flexible spending arrangements (FSAs), and health savings accounts (HSAs) are not taken into account for purposes of the small business health care tax credit.

If an employer pays only a portion of the premiums for the coverage provided to employees under the arrangement, with employees paying the rest, the amount of premiums counted in calculating the credit is only the portion paid by the employer. For purposes of the credit, including the requirement to make a uniform contribution of no less than 50 percent of the premium, any premium paid pursuant to a salary reduction arrangement under a section 125 cafeteria plan is not treated as paid by the employer.

Example. A church pays 80 percent of the premiums for employees’ health insurance, with employees paying the other 20 percent pursuant to a salary reduction arrangement under a cafeteria plan. Only the 80 percent premium amount paid by the church counts in calculating the credit.

In addition, the amount of an employer’s premium payments that counts for purposes of the credit is capped by the premium payments the employer would have made under the same arrangement if the average premium for the small group market in the state in which the employer offers coverage were substituted for the actual premium. For example, if an employer pays 80 percent of the premiums for coverage provided to employees and the employees pay the other 20 percent, the premium amount that counts for purposes of the credit is the lesser of 80 percent of the total actual premiums paid or 80 percent of the premiums that would have been paid for the coverage if the average premium for the small group market in the state were substituted for the actual premium. The average premium for the small group market does not apply separately to each type of coverage the employer offers, but rather provides an overall cap for all health insurance coverage provided by a qualified employer.

Key point. The average premium is determined by the Department of Health and Human Services (HHS). IRS Revenue Ruling 2010-13 sets forth the average premium for the small group market in each state for the 2010 tax year. This data is reproduced in Table 1 at the end of this article.

Example. In 2011 a church has two ministers and seven lay employees for a total of nine FTEs with average annual wages of $23,000 per FTE (excluding the ministers’ compensation, which is not considered “wages” in computing the credit). The church pays $80,000 in health care premiums for its nine employees, which does not exceed the average premium for the small group market in the employer’s state, and otherwise meets the requirements for the credit. The total amount of the church’s income tax and Medicare tax withholding plus the employer’s share of the Medicare tax is $30,000 in 2011. The credit is calculated as follows:

(1) Initial amount of credit determined before any reduction: (25% x $80,000) = $20,000

(2) Employer’s withholding and Medicare taxes: $30,000

(3) Total 2011 tax credit is $20,000 (the lesser of $20,000 and $30,000).

In 2014, the maximum tax credit for eligible tax-exempt small employers increases to 35 percent.

4. maximum credit amount

For tax years beginning in 2010 through 2013, the maximum credit for a tax-exempt qualified employer is 25 percent of the employer’s premium expenses that count towards the credit. However, the amount of the credit cannot exceed the total amount of income and Medicare (i.e., hospital insurance) tax the employer is required to withhold from employees’ wages for the year and the employer share of Medicare tax on employees’ wages for the year.

If a minister is an employee for income tax reporting purposes, he or she is taken into account in determining an employer’s FTEs for purposes of the health care tax credit. Also, premiums paid by the church for the health insurance coverage of a minister who is an employee can be taken into account in computing the credit, subject to limitations on the credit. If the minister is self-employed for income tax reporting purposes, he or she is not taken into account in determining an employer’s FTEs or premiums paid.

5. reducing the credit

The maximum credit goes to smaller employers—those with 10 or fewer full-time equivalent employees—paying annual average wages of $25,000 or less. The credit is completely phased out for employers that have 25 or more FTEs or that pay average wages of $50,000 or more per year. Because the eligibility rules are based in part on the number of FTEs, not the number of employees, employers that use part-time workers may qualify even if they employ more than 25 individuals.

If the number of FTEs exceeds 10, or if average annual wages exceed $25,000, the amount of the credit is reduced as follows:

If the number of FTEs exceeds 10, the reduction is determined by multiplying the otherwise applicable credit amount by a fraction, the numerator of which is the number of FTEs in excess of 10 and the denominator of which is 15.

If average annual wages exceed $25,000, the reduction is determined by multiplying the otherwise applicable credit amount by a fraction, the numerator of which is the amount by which average annual wages exceed $25,000 and the denominator of which is $25,000.

In both cases, the result of the calculation is subtracted from the otherwise applicable credit to determine the credit to which the employer is entitled. For an employer with both more than 10 FTEs and average annual wages exceeding $25,000, the reduction in the credit amount is equal to the sum of the amount of the two reductions. This sum may reduce the credit to zero for some employers with fewer than 25 FTEs and average annual wages of less than $50,000.

Example. A church has two ministers and five lay employees. All seven workers are treated as employees for income tax purposes by the church. The ministers’ combined wages are $85,000, and the lay employees’ combined wages are $130,000. The church pays $75,000 in health care costs for its employees. For 2010, it is eligible for the small business health care credit. The two ministers are taken into account in determining the church’s FTEs for purposes of the health care tax credit. But, compensation paid to ministers for duties performed in the exercise of their ministry is not subject to FICA taxes and therefore is not compensation taken into account for the purposes of computing average annual wages. Therefore, the church’s average annual wages are $130,000/7 or $18,571. Since this is less than $25,000, and the church has only seven employees, it is entitled to a full credit, computed by multiplying 25 percent times its health care expenditures of $75,000 ($18,750). Note that if the ministers’ wages were included in computing average annual wages, the church would not be eligible for any credit since its annual average wages would be more than $25,000.

Example. A church has 29 full-time equivalent employees, consisting of six ministers and 23 lay employees. The ministers’ wages are not considered in computing the church’s average annual wages for purposes of the small employer health care tax credit since they are not subject to Social Security and Medicare withholding (ministers are self-employed for Social Security with respect to compensation received for ministerial services). But, ministers are counted in computing FTEs, and so the church’s total workforce consists of 29 FTEs. Since this exceeds 25, the church is not eligible for the credit. This illustrates the purpose of the credit—to assist small employers in providing health coverage for their employees.

Example. In 2011, a church has 12 FTEs (including three ministers) with average annual wages of $30,000 per FTE (excluding the ministers’ compensation, which is not considered “wages” in computing the credit). The church pays $48,000 in health care premiums for its employees, which does not exceed the average premium for the small group market in the state, and otherwise meets the requirements for the credit. Its payroll taxes (income tax and Medicare withholdings plus the church’s share of Medicare taxes on persons deemed employees under FICA) are $15,000. The credit is calculated as follows:

(1) Initial amount of credit determined before any reduction: (25% x $48,000) = $12,000.

(2) Credit reduction for FTEs in excess of 10: ($12,000 x 2/15) = $1,600.

(3) Credit reduction for average annual wages in excess of $25,000: ($12,000 x $5,000/$25,000) = $2,400.

(4) Total credit reduction: ($1,600 + $2,400) = $4,000.

(5) Total 2011 tax credit without considering payroll taxes: ($12,000 – $4,000) = $8,000.

(6) Payroll taxes of $15,000.

(7) Total credit is the lesser of (5) or (6), or $8,000.

6. how to claim the credit

Small businesses can claim the credit for 2010 through 2013 and for any two years after that. For tax years 2010 to 2013, the maximum credit is 25 percent of premiums paid by eligible tax-exempt organizations. Beginning in 2014, the maximum tax credit will increase to 35 percent of premiums paid by eligible tax-exempt organizations.

Tax-exempt organizations will first use Form 8941 to figure their refundable credit, and then claim the credit on Line 44f of Form 990-T. Though primarily filed by those organizations liable for the tax on unrelated business income, Form 990-T will also be used by any eligible tax-exempt organization to claim the credit, regardless of whether they are subject to this tax. Form 990-T has been revised for the 2011 filing season to enable eligible tax-exempt organizations to claim the health care tax credit.

The deadline for filing Form 990-T is the 15th day of the fifth month following the end of a church’s tax year (May 15 of the following year for most churches).

To illustrate, to claim the credit for 2011, a church will need to file Form 990-T by May 15, 2012. For churches that operate on a fiscal year basis, the deadline is the 15th day of the fifth month following the end of their fiscal year.

Note that qualifying tax-exempt employers (including churches) having no taxable income to be offset with a tax credit will claim a “refundable” tax credit, meaning that the amount of the credit that would otherwise have offset taxable income is refunded to them.

Tip. If a tax-exempt eligible small employer is filing Form 990-T only to request a credit for small employer health insurance premiums, the IRS recommends the following steps:

1. Fill in the heading (the area above Part I) of Form 990-T except items E, H and I.

2. Enter -0- on line 13, column (A), line 34, and line 43.

3. Enter the credit from line 25 of Form 8941 on line 44f.

4. Complete lines 45, 48, 49 and the signature area.

5. Write “Request for 45R Credit Only” on the top of the Form 990-T.

Key point. The credit is refundable so long as it does not exceed the employer’s income tax withholding and Medicare tax liability.

Key point. Although the tax code requires section 501(c)(3) organizations to make their Form 990-T available for public inspection, this requirement does not apply to returns filed only to request a credit for the small employer health insurance premiums. Also, there is no requirement that section 501(c)(3) organizations make Form 8941 available for public inspection. An organization filing a Form 990-T only to request a credit for the small employer health insurance premium must write “Request for 45R Credit Only” across the top of the Form 990-T.

7. transition relief

For tax years beginning in 2010, certain transition relief applies with respect to the requirements for a qualifying arrangement. Specifically, an employer that pays at least 50 percent of the premium for each employee enrolled in coverage offered to employees by the employer is deemed to satisfy the qualifying arrangement requirement even though the employer does not pay a uniform percentage of the premium for each such employee. Accordingly, if the employer otherwise satisfies the requirements for the credit described above, it will qualify for the credit.

8. years the credit is available

The credit is initially available for any taxable year beginning in 2010, 2011, 2012, or 2013. Qualifying health insurance for claiming the credit for this first phase of the credit is health insurance coverage purchased from an insurance company licensed under state law. As noted above, the IRS has clarified that qualifying health insurance includes “an arrangement under which an otherwise qualifying small church employer pays premiums for employees who receive medical care coverage under a church welfare benefit plan.”

For taxable years beginning in years after 2013, the credit is only available to a qualified small employer that purchases health insurance coverage for its employees through a state “exchange” and is only available for a maximum coverage period of two consecutive taxable years beginning with the first year in which the employer or any predecessor first offers one or more qualified plans to its employees through an exchange.

The maximum two-year coverage period does not take into account any taxable years beginning in years before 2014. As a result, a qualified small employer could potentially qualify for this credit for six taxable years, four years under the first phase and two years under the second phase.

9. questions

This section addresses some common questions pertaining to the application of the small employer health insurance tax credit to churches.

Question 1. Our church has a preschool with six employees. Are these employees taken into account in computing the small employer health insurance tax credit?

Answer. Unfortunately, the tax code does not directly address this question, and the IRS has not provided any clarification. It is likely, though not certain, that the IRS would apply the “common law rules” pertaining to the definition of an “employer” for employment tax purposes (i.e., withholding and payment of Social Security, Medicare, and income taxes) in computing the number of employees for purposes of the small employer health insurance credit. These rules are found in several sources, including IRS Publication 15A:

Under common-law rules, anyone who performs services for you is your employee if you have the right to control what will be done and how it will be done. This is so even when you give the employee freedom of action. What matters is that you have the right to control the details of how the services are performed ….

If you have an employer-employee relationship, it makes no difference how it is labeled. The substance of the relationship, not the label, governs the worker’s status. It does not matter whether the individual is employed full time or part time …. You generally have to withhold and pay income, social security, and Medicare taxes on wages that you pay to common-law employees.

However, section 3401(d) of the tax code contains an important exception to the common law rules by defining an employer as “the person for whom an individual performs or performed any service, of whatever nature, as the employee of such person, except that if the person for whom the individual performs or performed the services does not have control of the payment of the wages for such services, the term employer means the person having control of the payment of such wages.” (emphasis added)

According to this provision, the fact that a preschool employee is performing services directly for the preschool rather than the church, and would therefore be an employee of the preschool under the common law rules, is subject to the general rule of section 3401(d) that “if the person for whom the individual performs or performed the services does not have control of the payment of the wages for such services, the term employer means the person having control of the payment of such wages.”

According to this precedent, it is likely that the employees of a church preschool would be considered church employees and included in computing the church’s eligibility for the small employer health insurance credit, if: (1) the preschool is not separately incorporated; (2) the preschool uses the church’s employer identification number for reporting employment taxes; and (3) the church pays the wages of preschool employees.

On the other hand, if a church-affiliated preschool is separately incorporated, and has its own employer identification number, and pays the wages of its employees, then it is unlikely that these employees would be included in determining the number of church employees for purposes of the small employer health insurance tax credit.

In some cases, a preschool may be separately incorporated, but use the church’s employer identification number. Are the employees of such a preschool counted in computing the number of church employees for purposes of the credit? The answer is less clear in “hybrid” scenarios like this. Perhaps the main point would be the definition of an “employer” under section 3401(d) of the tax code as the entity “having control of the payment of wages.” If the preschool employees’ wages are paid by the church, then the church would be the employer, even if the preschool operates with some level of independence under the governing documents of itself and the church.

This analysis is necessarily tentative given the lack of clarification from the IRS. Any future developments will be reported in the Church Law & Tax Report and Church Finance Today newsletters, as well as in future editions of the Church & Clergy Tax Guide.

Question 2. The instructions for Form 8941, page 2, under the heading “Individuals Considered Employees—Excluded employees,” states that “hours and wages of these [excluded] employees and premiums paid for them are not counted when you figure your credit.” So this seems to contradict the view that ministers are included in the employee count but not their wages.

Answer. There are a number of employees who are excluded in computing the credit, and they are listed on page 2 of the instructions to Form 8941. None of these applies to ministers, at least in most cases. They include the owner of a sole proprietorship, a partner, certain shareholders, and some family members. These employees are all identified specifically in tax code section 45R(e)(1) as “excluded employees” for purposes of the credit. Note that ministers are not included in the list of excluded employees, and so the statement in the instructions that the “hours and wages of these employees and premiums paid for them are not counted when you figure your credit” does not apply to ministers.

At the bottom of page 2 of the instructions to Form 8941 there is another section that addresses ministers directly. It states:

Ministers. A minister performing services in the exercise of his or her ministry is treated as self-employed for social security and Medicare purposes. However, for credit purposes, whether a minister is an employee or self-employed is determined under the common law test for determining worker status. Self-employed ministers are not considered employees.

This section correctly states that ministers are treated as employees in computing the credit so long as they satisfy the definition of a “common law employee.” The common law employee test is a test that is used for determining if someone is an employee or self-employed for income tax reporting purposes. Most pastors will satisfy this test, meaning that they will be counted in computing the number of church employees for purposes of the credit. However, in those rare instances where a pastor does not satisfy the common law employee test, he or she would not be counted in computing the number of church employees for purposes of the small employer credit.

Section 45R of the tax code states that in computing the credit the term “wages” has the meaning as in section 3121(a). Section 3121(a)(8) specifies that for Social Security, a duly ordained, commissioned, or licensed minister of a church is self-employed with respect to services performed in the exercise of ministry. This is true even if a minister is an employee for income tax purposes. So, the typical pastor who is an employee for income tax reporting, and self-employed for Social Security, is deemed an employee in computing the number of church employees for purposes of the credit, but, since his or her compensation is not “wages” under section 3121 of the tax code, the minister’s compensation is not taken into account in computing the church’s average annual wages.

IRS Notice 2010-82 provides the following explanation:

A minister performing services in the exercise of his or her ministry is treated as self-employed for Social Security and Medicare tax purposes. See §§ 1402(c)(2)(D)4 and 3121(b)(8)(A). However, for other tax purposes, including § 45R, whether a minister is an employee or self-employed is determined under the common law test for determining worker status. If, under the common law test, a minister is self-employed, the minister is not taken into account in determining an employer’s FTEs and premiums paid because § 45R(e)(A)(i) excludes a self-employed individual from the term “employee” for purposes of the credit. If, under the common law test, the minister is an employee, the minister is taken into account in determining an employer’s FTEs and premiums paid by the employer for the minister’s health insurance coverage can be taken into account in computing the credit, subject to limitations on the credit. (Note that, under § 45R(f)(1)(B), a tax-exempt employer’s § 45R credit cannot exceed the total of the tax-exempt eligible small employer’s income tax and Medicare tax withholding and its Medicare tax liability for the year).

Because compensation of a minister performing services in the exercise of his or her ministry is not subject to Social Security or Medicare tax under the Federal Insurance Contributions Act (FICA), a minister has no wages as defined under § 3121(a) for purposes of computing an employer’s average annual wages.

Similarly, the following two questions and answers appear on the IRS website in the course of an explanation of the credit:

24. Can a tax-exempt organization described in section 501(c) include a minister in its calculation when determining eligibility for the small business health care tax credit?

A. The answer depends on whether, under the common law test for determining worker status, the minister is considered an employee of the tax-exempt organization or self-employed. If the minister is an employee, he or she is taken into account in determining an employer’s FTEs for purposes of the health care tax credit. Also, premiums paid by the employer for the health insurance coverage of a minister who is an employee can be taken into account in computing the credit, subject to limitations on the credit. If the minister is self-employed, he or she is not taken into account in determining an employer’s FTEs or premiums paid.

25. Are the wages of a minister taken into account when computing average annual wages for purposes of determining eligibility for the credit?

A. No. Compensation paid to ministers who are common law employees for duties performed in the exercise of their ministry is not subject to FICA taxes and is not wages as defined in section 3121(a). Thus, the wages of a minister that is a common law employee are not (to) be taken into account for purposes of computing average annual wages.

In conclusion, ministers who are employees under the common law test (most ministers) are taken into account in computing the number of church employees, but their compensation is not considered in computing a church’s average annual wages.

Question 3. Some ministers have elected voluntary withholding of income taxes and self-employment taxes. Will the wages of these ministers be counted in computing a church’s average annual wages?

Answer. No. Section 45R of the tax code states that in computing the credit the term “wages” has the meaning as in section 3121(a), which pertains to Social Security and Medicare taxes (“FICA” taxes) for employees. However, since 3121(a)(8) specifies that for Social Security and Medicare taxes, a duly ordained, commissioned, or licensed minister of a church is self-employed with respect to services performed in the exercise of ministry, his or her compensation is not “wages” under section 3121 of the tax code and therefore is not taken into account in computing the church’s average annual wages even if a minister has entered into a voluntary withholding arrangement with the church. As the IRS notes in Notice 2010-82: “Because compensation of a minister performing services in the exercise of his or her ministry is not subject to Social Security or Medicare tax under the Federal Insurance Contributions Act (FICA), a minister has no wages as defined under § 3121(a) for purposes of computing an employer’s average annual wages.”

Question 4. Why can’t the small employer health insurance credit exceed the amount of payroll taxes paid by the church?

Answer. For small taxable employers the credit is a dollar-for-dollar reduction in actual tax liability that is computed and reported on their tax returns. Since tax-exempt employers, including churches, pay no taxes, the credit is “refundable.” However, to comply with the basic principle that the credit is available only to offset actual tax liability, the maximum refundable credit for tax-exempt employers is the amount of their payroll tax liability, which is defined by section 45R as the sum of the following three amounts:

income taxes withheld from employees

Medicare (hospital insurance) taxes withheld from employees, and

the employer’s share of Medicare taxes

Question 5. What is the maximum credit for a tax-exempt qualified employer?

Answer. For tax years beginning in 2010 through 2013, the maximum credit for a tax-exempt qualified employer is 25 percent of the employer’s premium expenses that count toward the credit. However, the amount of the credit cannot exceed the total amount of income and Medicare (i.e., hospital insurance) tax the employer is required to withhold from employees’ wages for the year and the employer’s share of Medicare tax on employees’ wages for the year.

Question 6. What about churches that filed Form 8274 several years ago electing to exempt themselves from the employer’s share of Social Security and Medicare taxes?

Answer. By filing Form 8274, a church exempts itself from the employer’s share of Social Security and Medicare taxes for its lay employees. But, in addition, by filing the form, the church’s lay employees are treated as self-employed for Social Security, meaning that they pay the self-employment tax rather than Social Security and Medicare taxes. While the IRS has not yet addressed this question, it is likely that the “payroll taxes” limitation on the small employer health insurance credit will be affected since the church will not be withholding Medicare taxes and will not be paying Medicare taxes. This means that the only component of payroll taxes as defined by section 45R of the tax code will be income taxes withheld. The effect is a lower payroll tax limit on the amount of the credit.

Question 7. What about ministers who have elected voluntary withholding of taxes? Will this affect the amount of the church’s credit? If so, should churches reconsider whether they want to accommodate a pastor’s request for voluntary withholding of income taxes and self-employment taxes?

Answer. Section 45R of the tax code, which contains the small employer health insurance credit, limits the credit for tax-exempt employers (including churches) to “the amount of the payroll taxes of the employer during the calendar year in which the taxable year begins.” Section 45R(f)(3) defines “payroll taxes” as the sum of the following three amounts:

(1) income taxes “required to be withheld from the employees of the tax-exempt eligible small employer,”

(2) Medicare taxes “required to be withheld from such employees,” and

(3) the employer’s share of Medicare taxes.

Ministers wages are exempt from income tax withholding with respect to services performed in the exercise of their ministry, and they are not subject to Medicare taxes with respect to these services (instead, they pay self-employment taxes). So, the “payroll tax limit” on the amount of the credit will not be affected by ministerial employees.

However, many pastors and churches have entered into “voluntary” withholding arrangements whereby the church withholds income taxes from a pastor’s wages. In some cases, a pastor requests that additional income taxes be withheld to offset self-employment tax liability. These additional withheld taxes are deemed income taxes and not Social Security or Medicare taxes.

Of the three components of “payroll taxes” under section 45R(f)(3), the only one that would be affected by pastoral compensation would be withheld income taxes for pastors who have elected voluntary withholding. Are these voluntarily withheld income taxes counted in computing the “payroll tax” limit on the amount of the small employer health insurance credit? The obvious answer is “no,” since these taxes are voluntarily withheld and not required to be held (to use the language of section 45R(f)(3)). However, this issue has not been addressed or clarified by the tax code, regulations, IRS, or the courts, and so a definitive answer is not possible. Church leaders should consult with a tax professional in making a final decision. Note that if these voluntarily withheld taxes are included in computing the payroll tax limit, this will have the effect of increasing the credit for some churches.

Question 8. Does a church have to use Form 990-T if it is only claiming the credit?

Answer. The IRS has stated that “tax-exempt organizations will include the amount of the credit on Line 44f of revised Form 990-T (Exempt Organization Business Income Tax Return). Form 990-T has been revised to enable eligible tax-exempt organizations, even those that owe no tax on unrelated business income, to claim the small business health care tax credit.” An organization filing a Form 990-T only to request a credit for the small employer health insurance premium must write “Request for 45R Credit Only” across the top of the Form 990-T.

Although the tax code requires section 501(c)(3) organizations to make their Form 990-T available for public inspection, this requirement does not apply to returns filed only to request a credit for the small employer health insurance premiums. Also, there is no requirement that section 501(c)(3) organizations make Form 8941 available for public inspection.

Question 9. Are health insurance premiums paid by a church for its pastors included in computing the credit?

Answer. Yes. The following question and answer appears on the IRS website in the course of an explanation of the credit:

24. Can a tax-exempt organization described in section 501(c) include a minister in its calculation when determining eligibility for the small business health care tax credit?

A. The answer depends on whether, under the common law test for determining worker status, the minister is considered an employee of the tax-exempt organization or self-employed. If the minister is an employee, he or she is taken into account in determining an employer’s FTEs for purposes of the health care tax credit. Also, premiums paid by the employer for the health insurance coverage of a minister who is an employee can be taken into account in computing the credit, subject to limitations on the credit. If the minister is self-employed, he or she is not taken into account in determining an employer’s FTEs or premiums paid.

Question 10. When calculating the number of employees, are we to include all employees, or only full-time employees?

Answer. To be eligible for the credit, an employer must have fewer than 25 “full-time equivalent employees” (FTEs) for the tax year and pay average annual wages of less than $50,000 per FTE.

The number of an employer’s FTEs is determined by dividing (1) the total hours of service for which the employer pays wages to employees during the year (but not more than 2,080 hours for any employee) by (2) 2,080. The result, if not a whole number, is then rounded to the next lowest whole number (unless the result is less than one, in which case, the employer rounds up to one FTE).

To calculate the total number of hours of service, which must be taken into account for an employee for the year, the employer may use any of the following methods:

Method 1. Determine actual hours of service from records of hours worked and hours for which payment is made or due, including hours for paid leave;

Method 2. Use a days-worked equivalency whereby the employee is credited with eight hours of service for each day for which the employee would be required to be credited with at least one hour of service under Method 1; or

Method 3. Use a weeks-worked equivalency whereby the employee is credited with 40 hours of service for each week for which the employee would be required to be credited with at least one hour of service under Method 1. Employers do not have to use the same method for all employees, but may apply different methods for different classifications of employees, if the classifications are reasonable and consistently applied. For example, it is permissible for an employer to use Method 1 for all hourly employees and Method 3 for all salaried employees. Employers may change the method for calculating employees’ hours of service for each taxable year.

Question 11. Does this credit apply in a situation where the only paid staff member is the pastor, assuming the annual salary is less than $50,000?

Answer. Yes. The minister is counted in computing the number of employees, but his or her wages are not deemed to be compensation in computing the average annual wages limit of $50,000. So, in the case of a church with one pastor and no other paid staff, the church would have one employee and average annual wages of under $25,000 (ministers’ compensation is excluded from the definition of “wages” in computing the credit), entitling it to the full credit of 25 percent times the health insurance premiums paid by the church for the pastor, assuming that the church pays at least half of the premium amount.

The credit is limited to the income taxes and Medicare taxes withheld by the church plus the church’s share of Medicare taxes. But, since ministers’ wages are exempt from income tax withholding, and ministers are not subject to FICA taxes with regard to compensation received for their ministerial services, a church will have no “payroll taxes” (income taxes and Medicare taxes withheld, plus the church’s share of Medicare taxes). This probably means that a church with only one pastor and no other compensated employee will be ineligible for the credit since it will have no payroll taxes and its credit cannot exceed the amount of payroll taxes paid. This is an open question that has not been answered by section 45R of the tax code or the IRS.

One possible solution would be for the pastor to elect voluntary withholding of income taxes. If the pastor increases income tax withholding to account for both income tax and self-employment tax liability, this could have the effect of increasing the “payroll tax” ceiling by enough to make the credit worthwhile. Note, however, that voluntary withholding is available only to ministers who report their income taxes as employees, which may be the incorrect status for some ministers who are the sole compensated worker at their church. Also, note that if the pastor is a church’s sole compensated worker, and the pastor reports income taxes as a self-employed worker, this may affect the church’s eligibility for the credit since the credit only applies to health insurance provided by an employer for its employees.

Churches with no employees other than a pastor should consult with a tax professional to resolve this issue. Any clarification will be presented in future editions of this newsletter.

Question 12. Churches can obtain a six-month extension to file Form 990-T to report unrelated business income taxes. Can they obtain a six-month extension to file this form if they have no unrelated business income taxes to report and are using it solely to claim the small employer health insurance tax credit?

Answer. The instructions to Form 990-T state that “corporations may request an automatic six-month extension of time to file Form 990-T by using Form 8868, Application for Extension of Time To File an Exempt Organization Return.” Unfortunately, the instructions do not state that an extension is available if the sole reason for filing Form 990-T is to claim the credit, and this question has not been addressed by section 45R, the IRS, or the courts. Church leaders should contact the IRS, or a tax professional, for advice if an extension is needed. Of course, given the relatively few lines on Form 990-T that a church needs to complete to claim the credit, the need for a filing extension should be rare.

What about Ministers?

Note the following two points regarding the treatment of ministers for purposes of the health insurance tax credit:

1. If a minister is an employee under the so-called “common law employee test,” he or she is taken into account in determining an employer’s FTEs for purposes of the health care tax credit. Also, premiums paid by the church for the health insurance coverage of a minister who is an employee can be taken into account in computing the credit, subject to limitations on the credit. If the minister is self-employed for income tax reporting purposes, he or she is not taken into account in determining an employer’s FTEs or premiums paid.

2. Compensation paid to ministers who are employees for duties performed in the exercise of their ministry is not subject to FICA taxes and is not compensation subject to income tax withholding. As a result, their wages are not taken into account for the purposes of computing average annual wages.

The fact that ministers are taken into account in determining a church’s FTE count, but their wages are not considered in computing the average annual wages paid by a church, makes it more likely that some churches will benefit from the credit since the generally higher wages paid to ministers are removed from consideration.

See chapter 2 in Richard Hammar’s 2011 Church & Clergy Tax Guide for a full explanation of the common law employee test. This is one of the tests used by the IRS and the courts in determining a minister’s reporting status for federal income tax reporting purposes.

Checklist for Computing the Credit

The following checklist is based on a three-step procedure available on the IRS website:

STEP 1. Determine the total number of employees (include all employees meeting the “common law employee” test, which will include most ministers):

_________ Full-time employees (enter the number of employees who work at least 40 hours per week):

+

_________Add full-time equivalent of part-time employees (calculate the number of full-time equivalents by dividing the total annual hours of part-time employees by 2,080)

= _______________ total employees

If the total number of employees is less than 25, go to STEP 2.

STEP 2. Calculate the average annual wages of employees (excluding compensation paid to ministers):

_________ Take the total annual wages paid to employees

÷

Divide by the number of employees from STEP 1 (total wages, number of employees)

= ____________ average wages

If the result is less than $50,000, AND

STEP 3. You pay at least half of the health insurance premiums for your employees at the single (employee-only) coverage rate, then:

You may be able to claim the small business health care tax credit of up to 25 percent of the amount of health insurance premiums paid for your employees. Note the following limits and conditions:

The credit is reduced if you have more than 10 full-time equivalent employees.

The credit is reduced if you pay average annual wages in excess of $25,000 per employee.

The credit cannot exceed the average premium for the small group market in your state.

The credit is “refundable” for tax-exempt employers, meaning that it is refunded in cash. However, it cannot exceed an employer’s “payroll taxes,” which are defined as income tax and Medicare withholdings and the employer’s share of Medicare taxes.

Constitutionality of the Affordable Care Act

In late 2010, a federal district court judge in Florida declared the entire Affordable Care Act unconstitutional. The judge ruled that the requirement that American citizens obtain health insurance, with criminal penalties for noncompliance, exceeded the constitutional authority of Congress. And, given the centrality of this provision to the Act’s purposes, the judge ruled that the entire Act was unconstitutional. That ruling is on appeal. Other challenges are pending. Ultimately, the United States Supreme Court may determine the law’s validity. For now, it is important to recognize that there is some doubt as to the continuing availability of the small employer health care tax credit.

Table 1: State Average Premiums for Small Group Markets

The following chart sets forth the average premium for the small group market in each state (and Washington, D.C.) for the 2010 taxable year. Family coverage includes any coverage other than employee-only (or single) coverage.

StateEmployee-only coverageFamily coverage

| Alaska |

$6,024 |

$13,723 |

| Alabama |

$4,441 |

$11,275 |

| Arkansas |

$4,329 |

$9,677 |

| Arizona |

$4,495 |

$10,239 |

| California |

$4,628 |

$10,957 |

| Colorado |

$4,972 |

$11,437 |

| Connecticut |

$5,419 |

$13,484 |

| District of Columbia |

$5,355 |

$12,823 |

| Delaware |

$5,602 |

$12,513 |

| Florida |

$5,161 |

$12,453 |

| Georgia |

$4,612 |

$10,598 |

| Hawaii |

$4,228 |

$10,508 |

| Iowa |

$4,652 |

$10,503 |

| Idaho |

$4,215 |

$9,365 |

| Illinois |

$5,198 |

$12,309 |

| Indiana |

$4,775 |

$11,222 |

| Kansas |

$4,603 |

$11,462 |

| Kentucky |

$4,287 |

$10,434 |

| Louisiana |

$4,829 |

$11,074 |

| Massachusetts |

$5,700 |

$14,138 |

| Maryland |

$4,837 |

$11,939 |

| Maine |

$5,215 |

$11,887 |

| Michigan |

$5,098 |

$12,364 |

| Minnesota |

$4,704 |

$11,938 |

| Missouri |

$4,663 |

$10,681 |

| Mississippi |

$4,533 |

$10,501 |

| Montana |

$4,772 |

$10,212 |

| North Carolina |

$4,920 |

$11,583 |

| North Dakota |

$4,469 |

$10,506 |

| Nebraska |

$4,715 |

$11,169 |

| New Hampshire |

$5,510 |

$13,624 |

| New Jersey |

$5,607 |

$13,521 |

| New Mexico |

$4,754 |

$11,404 |

| Nevada |

$4,553 |

$10,297 |

| New York |

$5,442 |

$12,867 |

| Ohio |

$4,667 |

$11,293 |

| Oklahoma |

$4,838 |

$11,002 |

| Oregon |

$4,681 |

$10,890 |

| Pennsylvania |

$5,039 |

$12,471 |

| Rhode Island |

$5,887 |

$13,786 |

| South Carolina |

$4,899 |

$11,780 |

| South Dakota |

$4,497 |

$11,483 |

| Tennessee |

$4,611 |

$10,369 |

| Texas |

$5,140 |

$11,972 |

| Utah |

$4,238 |

$10,935 |

| Virginia |

$4,890 |

$11,338 |

| Vermont |

$5,244 |

$11,748 |

| Washington |

$4,543 |

$10,725 |

| Wisconsin |

$5,222 |

$12,819 |

| West Virginia |

$4,986 |

$11,611 |

| Wyoming |

$5,266 |

$12,163 |

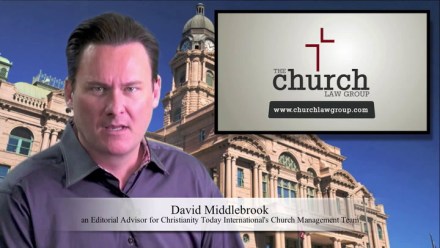

Church Law & Tax Report is published six times a year by Christianity Today International, 465 Gundersen Dr. Carol Stream, IL 60188. (800) 222-1840.© 2011 Christianity Today International. editor@churchlawandtax.com All rights reserved. This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is sold with the understanding that the publisher is not engaged in rendering legal, accounting, or other professional service. If legal advice or other expert assistance is required, the services of a competent professional person should be sought. “From a Declaration of Principles jointly adopted by a Committee of the American Bar Association and a Committee of Publishers and Associations.” Annual subscription: $69. Subscription correspondence: Church Law & Tax Report, PO Box 37012, Boone, IA 50037-0012.

Richard R. Hammar is an attorney, CPA and author specializing in legal and tax issues for churches and clergy.